Can a Solar Panel Surplus Help Shield the U.S. Solar Industry from New Tariffs?

The U.S. solar industry is no stranger to trade turbulence, but recent moves from the White House have sent shockwaves through an already complex landscape. As new tariffs hit Southeast Asian solar imports—the backbone of the U.S. solar supply chain—the big question for the industry becomes: can a surplus of stockpiled solar panels act as a buffer against economic disruption?

At SunSent Solar, we’re diving into the numbers, the policy shifts, and the industry responses that could determine whether this tariff wave sinks solar progress or helps build a stronger domestic foundation.

📉 The New Tariffs Are No Joke

In April 2025, the Biden-to-Trump transition brought with it a brutal new trade policy dubbed the “Liberation Day” tariffs. The new tariffs target Southeast Asian nations—countries responsible for over 80% of U.S. solar panel imports.

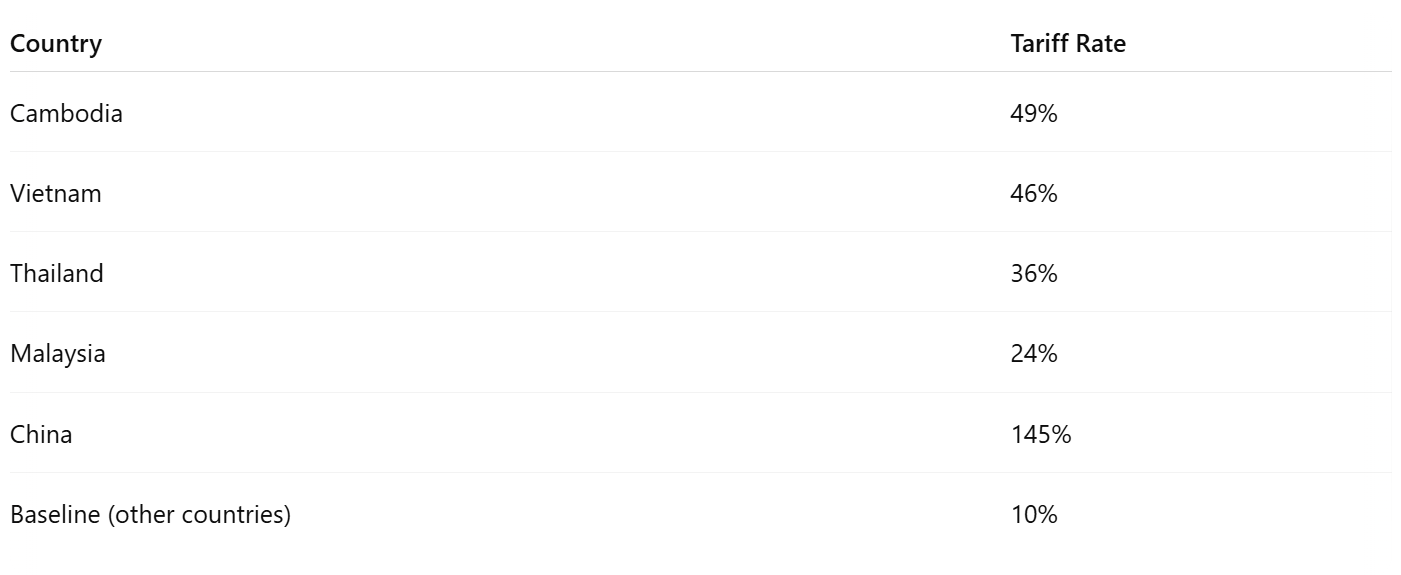

Here’s what the new tariff landscape looks like:

If that weren’t enough, the U.S. Department of Commerce is poised to unleash anti-dumping and countervailing duties (AD/CVD) as high as 3,521% on some Southeast Asian solar imports, pending a vote by the International Trade Commission in June 2025.

🧾 A Decade of Tariffs: How Did We Get Here?

The latest tariffs are just the newest chapter in a long, winding policy saga.

- 2012-2014 (Obama): Tariffs first targeted Chinese-made panels due to unfair trade practices, prompting manufacturers to reroute supply chains through Southeast Asia.

- 2018 (Trump): 30% safeguard tariffs led to:

- 62,000 lost jobs

- $19 billion in lost private investment

- 10.5 GW drop in solar deployment

- 2022 (Biden): Extended tariffs with key exceptions (bifacial panels, increased import limits) while pausing new duties to protect installations under the Inflation Reduction Act (IRA).

- 2025 (Trump 2.0): New tariffs + retroactive duties looming + the end of Biden’s tariff pause = a perfect storm.

🔋 Why the Surplus Matters

As the latest tariffs hit, a surprising twist is offering temporary relief: a massive solar panel stockpile.

📦 Estimated Inventory: 50 gigawatts (GW) of solar panels—equal to the U.S. deployment total in all of 2024.

This inventory—stockpiled during the Biden administration’s 2-year pause on new duties—could buy time for the industry. Larger companies with the resources to hoard panels now have a cushion to insulate against rising prices and unpredictable supply.

However, this is not a long-term solution.

🧯 The Catch: Not Everyone Can Stockpile

According to industry insiders, only the big dogs—Sunrun, Sunnova, and other national installers—had the capital to plan ahead. Most small to mid-sized solar companies operate on tight margins and use just-in-time inventory, meaning they buy panels for specific jobs rather than warehouse massive quantities.

💬 “These big bank-backed brands have unlimited money. And they’re the ones sucking up all the residential stuff.” —Tony Lostracco, CEO, Public Service Solar

Some distributors and even solar financing companies have tried to help by buying inventory on behalf of their partners. Still, without a consistent supply of affordable panels, many smaller installers may be squeezed out of the market.

⚠️ Tariffs Threaten the Battery Boom, Too

Solar panels aren’t the only part of the equation. Battery storage—a key piece of energy independence—is also in jeopardy.

- China controls 80% of global lithium chemical production.

- Chinese batteries now face a 145% tariff.

- Tesla, the #1 battery brand in 2024, will see sharp cost increases.

- A projected 18 GW of new storage capacity in 2025 may not materialize.

These tariffs are already hiking up prices and slowing down battery deployment. And since most U.S.-made batteries still depend on Chinese raw materials, even domestic manufacturers aren’t in the clear.

📈 The Demand Dilemma

With rising prices and limited inventory, the solar market could experience a demand contraction of up to 20%, according to Neel Desai, CEO of Sunrgy. This isn’t just about cost—it’s about uncertainty. Manufacturers are delaying shipments. Installers are unsure what inventory will cost in 3 months. Homeowners are hesitant to move forward on projects amid fluctuating quotes.

💬 “The problem isn't the tariffs, the problem is the fear of the tariffs.” —Tony Lostracco

Even with long-term benefits like incentivizing U.S. production and quality standards, the short-term pain is real.

🏭 Domestic Solar Can’t Fill the Gap… Yet

Thanks to the Inflation Reduction Act, U.S. solar manufacturing is growing. But we’re still not there:

- Most U.S. panel makers still import photovoltaic (PV) cells from abroad.

- Domestic material supply is extremely limited.

- The U.S. doesn’t currently have the capacity to replace Southeast Asian imports at scale.

Desai predicts a “big fight for product” as everyone shifts focus to domestic suppliers—who can’t keep up with the demand.

🔮 What Comes Next?

The U.S. solar industry has been through this before—and survived. From the collapse of Solyndra in the early 2010s to today’s trade battles, solar has proved surprisingly resilient.

However, the fate of the current surplus depends on:

- Whether retroactive tariffs are enforced after the December 2024 deadline.

- How much demand drops due to price spikes.

- How quickly domestic manufacturing can ramp up.

- Whether the 50 GW surplus is used wisely—to keep installations moving, support small installers, and stabilize the market.

🌞 What It Means for You

At SunSent Solar, we’re keeping a close eye on these developments to protect our customers and our projects. While other companies scramble for inventory or raise prices, we’re focused on staying nimble, sourcing smart, and maintaining fair pricing.

Whether you’re considering solar panels or a battery system, the best time to act may be now—while the industry still benefits from surplus inventory and before tariffs drive costs higher.

Have questions about how tariffs affect your solar options? Reach out. We’re happy to walk you through what’s changing, what’s not, and how to make the smartest solar decision for your home. Call 636.757.3083.

Want to learn more about solar in 2025? Fill out the from at SunSent.com to subscribe to our weekly newsletter for updates on pricing, technology, rebates, and more.