The Solar Tax Credit & Why 2025 is the Smartest Year Yet to Go Solar

Let’s cut to the chase: if you've ever considered going solar, 2025 might just be your last, best chance to do it for cheap. With a massive 30% federal tax credit still in play, and a warehouse stocked with pre-tariff solar panels ready to roll, SunSent Solar is making it easier and more affordable than ever to flip the switch on your energy independence.

Sound too good to be true? Stick around. We’ll break down everything you need to know about the solar tax credit, why it matters right now, and how SunSent can help you save big — before potential changes hit your wallet hard.

First Things First: What’s the Federal Solar Tax Credit?

The federal solar investment tax credit (ITC) is a dollar-for-dollar reduction in the amount of income tax you owe. That means when you go solar, you can claim 30% of your total system cost as a credit on your federal tax return.

💰 Translation: If your solar setup costs $25,000, you can slice $7,500 right off your tax bill. That’s real money back in your pocket.

There’s no cap on how much you can claim, and no income limits, which means everyone — not just the ultra-wealthy — can take advantage.

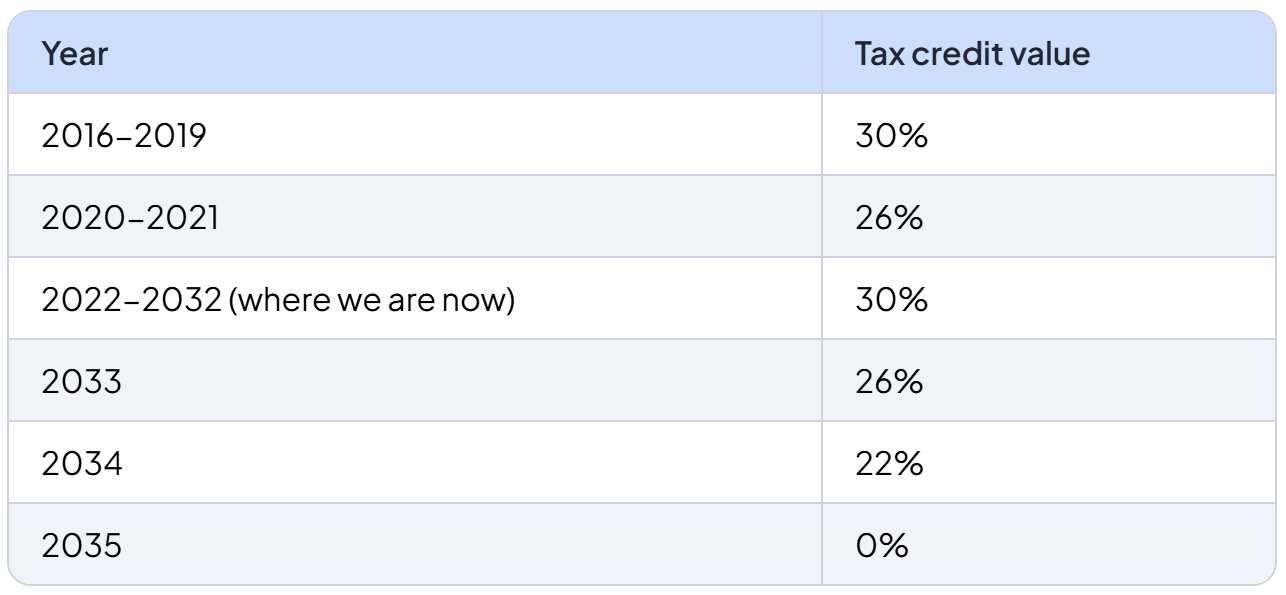

And here's the kicker: this 30% credit is locked in only until 2032. After that, it's on a countdown to zero by 2035. But with political shifts and proposed funding freezes circling like vultures, there’s no telling how long this golden window will really stay open.

Why 2025 is The Year to Go Solar

1. The Tax Credit is Still 30% — But Maybe Not for Long

Despite headlines and executive orders threatening funding for the Inflation Reduction Act (the legislation that guarantees the solar tax credit), Congress already approved 2025’s incentives, which means you’re still in the clear this year.

However, nothing in politics is ever really certain. Legal challenges are mounting. Funding pauses are being debated. You don’t want to wait until the dust settles to start saving.

2. We’ve Got Pre-Tariff Panels in Stock — That Means Cheaper Installs for You

A new wave of tariffs on solar panels from Southeast Asia is about to drive prices up nationwide. Luckily, at SunSent Solar, we planned ahead.

Our warehouse is stocked with top-tier, pre-tariff panels, which means we can lock in the current low costs before the price hike hits. But once they’re gone — they’re gone.

3. You Can Stack the Federal Tax Credit With Other Incentives

In Missouri and Illinois, there are local rebates, sales tax exemptions, and property tax protections that add even more value when you install solar. Plus, with net metering, you can get credited for excess energy you send back to the grid.

Bottom line? You’re saving money upfront, long-term, and on your taxes. It’s a triple win.

What’s Covered by the 30% Tax Credit?

Not everything solar-related is covered — but all the good stuff is. From EnergySage.

✔️ Solar panels

✔️ Inverters and mounting hardware

✔️ Installation labor, permitting, and inspections

✔️ Home batteries (like Tesla Powerwall 3) over 3kWh

✔️ Sales tax on qualifying equipment

🚫 Not covered? Roof repairs, tree removal, or unrelated electrical upgrades.

And remember — you must own your system to qualify. Leases and power purchase agreements (PPAs)? No dice.

How to Claim the Solar Tax Credit in 2025 (We’ll Help With That)

You claim the credit when you file your taxes using IRS Form 5695. If your credit is bigger than your tax bill, you can roll over the unused portion into future years (as long as it’s before 2035).

Not sure how to handle the paperwork? No stress — SunSent will walk you through the entire process, and make sure you’ve got everything you need when it’s tax time.

What’s the Rush? A Real Talk Reminder

Here’s what we’re seeing from homeowners on the fence:

They wait. They watch. They hope prices drop.

But with federal uncertainty looming, tariffs kicking in, and panel prices rising,

waiting could mean paying more and saving less.

When you go solar in 2025 with SunSent, you:

- Lock in the 30% tax credit

- Take advantage of pre-tariff panel pricing

- Slash your energy bills permanently

- Increase your property value

- Take control of your power, rain or shine

We’re not just your installer. We’re your local solar team — born and raised in the Midwest, here to handle everything from design to installation to post-install support. Whether you’ve got questions, a quirky roof, or a tight timeline, we’ve got your back.

TL;DR: This Is Your Solar Moment

✅ 30% Federal Tax Credit still active

✅ Pre-tariff panels = lower costs

✅ Stack incentives for extra savings

✅ Trusted local team (hey, that’s us)

✅ Start saving on Day 1

Ready to Talk Solar?

We’ll give you a free quote, show you how much you could save, and help you grab that tax credit before anything changes.

👉 Click here to schedule your solar consultation now.

SunSent Solar — powering homes and saving wallets since 2016. Call 636.757.3083 if you have any questions.