How To Secure Your Energy Future Without the Federal Tax Credit

As the window closes on the 30% Federal Residential Clean Energy Credit (formerly known as the ITC), many homeowners might feel a sense of urgency, or perhaps, disappointment, thinking they’ve missed the peak time to go solar.

At SunSent Solar, we’re here to tell you: Solar still pays for itself, and then some.

The financial fundamentals of residential solar—driven by soaring utility rates and continually falling system costs—remain incredibly strong. The federal credit was a wonderful accelerant, but it was never the backbone of solar’s enduring value. As industry experts like those at EnergySage have highlighted, the math still overwhelmingly favors generating your own power. For any homeowner considering a smarter, more stable future for their home finances, the time to install solar panels is still now.

Why the Economics of Solar Are Stronger Than Ever

The case for solar is built on a widening financial gap between the cost of utility power and the cost of self-generated solar power. This divergence is the heart of solar's enduring profitability.

1. The Decisive Decline in Solar Panel Costs

The good news is relentless: solar equipment costs continue their downward trend. Data compiled by industry leaders, including EnergySage, shows the price per watt for solar installations has plummeted dramatically over the last decade. Even with global supply chain fluctuations, the long-term cost curve for solar hardware remains decisively downward.

This continued efficiency and cost-reduction in manufacturing means that, while the tax credit disappearing makes the initial outlay higher, the base price of the system itself has never been lower.

2. The Unstoppable Climb of Utility Electricity Rates

In stark contrast to solar costs, utility electricity rates are climbing at an alarming pace. The forces driving these increases show no signs of slowing down:

- The Data Center and AI Boom: The immense power hunger of the artificial intelligence (AI) sector, which is building massive data centers across the country, is straining the existing electric grid. Experts note that this unprecedented demand for power will require significant, expensive investment in our aging infrastructure. Utilities pass these costs directly on to you, the consumer, in the form of higher rates.

- Grid Modernization and Climate Resilience: Our outdated power grid requires billions in upgrades to handle new power loads, severe weather events driven by climate change, and the increasing electrification of transportation and homes. These necessary, large-scale investments are funded by rate hikes.

- Natural Gas Volatility: A significant portion of the nation's electricity is still generated by natural gas, and the cost of this fuel is subject to major market volatility and export demands. As natural gas costs rise, so does your monthly electricity bill.

The SunSent Solar Advantage: When you install a solar energy system, you effectively lock in a predictable, low cost for a significant portion of your energy consumption for decades. You create a financial firewall against the unpredictable rate hikes that will continue to plague your non-solar neighbors.

The New Payback Reality: Longer, but Exceptionally Profitable

Without the 30% federal incentive, the national average time it takes for a solar system to pay for itself (the payback period) will naturally extend. As an analysis shared by EnergySage shows, this period might jump from around seven years to approximately ten to twelve years nationally.

While that extension might sound discouraging, it is critical to keep the big picture in mind:

- Lifetime Value is Massive: Most high-quality solar panels come with a performance warranty of 25 years and are expected to operate for 30 years or more. Even with a 12-year payback period, you are still securing 18+ years of essentially free electricity. When you factor in the avoided cost of ever-increasing utility rates during those two decades, the total lifetime savings are often in the tens of thousands of dollars.

- Solar is an Appreciation Asset: Unlike a car or most appliances, a solar system is one of the few home improvements that provides a significant financial return and typically increases your home’s value, making it more attractive to future buyers.

Making Solar Accessible: Financing Options for Every Homeowner

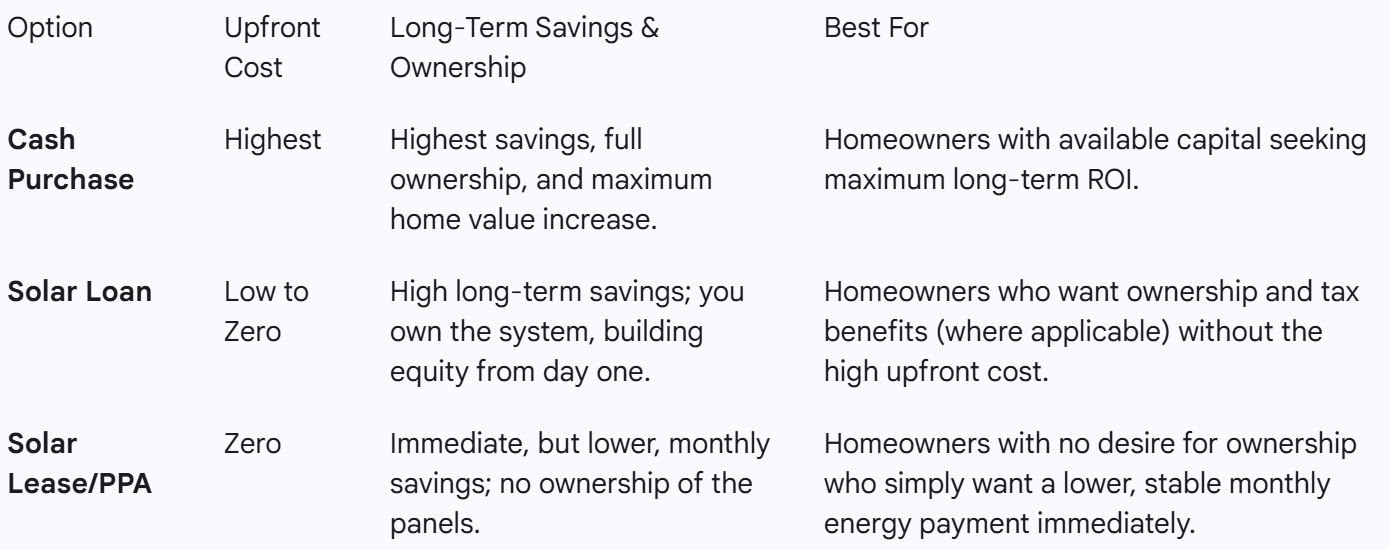

If the upfront cost without the tax credit is a concern, SunSent Solar is committed to ensuring solar remains accessible through flexible financing and ownership options:

Note: With a Solar Lease or Power Purchase Agreement (PPA), the third-party company claims the federal tax credit (since they own the asset), but they pass some of that savings to you in the form of a lower monthly rate. This option remains a strong pathway for immediate savings and is especially attractive for homeowners with limited federal tax liability.

FAQ: Separating Fact from Fiction in a Post-Credit World

Q: Is the extended payback period a dealbreaker?

A: Absolutely not. An average 10-12 year payback on an asset with a 25-30+ year lifespan is an exceptional return on investment. The critical factor is that the decades of free electricity are secured against unpredictable utility rate hikes.

Q: Why are US solar costs still higher than places like Australia?

A: Soft Costs. As the industry notes, two-thirds of installation costs are often "soft costs" (permitting, inspection, customer acquisition, etc.). The good news is that state and local efforts, like the recent streamlining legislation in Texas and Florida mentioned in the EnergySage analysis, are actively working to reduce this "red tape," which will drive prices down further over time.

Q: Do I need battery storage to make solar worth it now?

A: Not necessarily, but it is highly recommended. Solar with net metering alone still provides excellent financial returns. However, the rapidly falling cost of battery storage, combined with increasing grid instability, makes pairing solar with a battery a smart investment for total energy security and resilience during outages.

Q: Will local incentives still exist?

A: Yes. State, local, and utility-specific incentives (like Net Metering, local rebates, or SRECs in some areas) are often independent of the federal tax credit and continue to play a crucial role in lowering costs and shortening payback periods. We'll help you navigate all available programs.

Final Word: Control Your Future with SunSent Solar

The end of the 30% federal tax credit marks a financial change, but not an end to solar’s incredible value proposition. Every month you delay, you are choosing to remain exposed to the escalating, unpredictable prices of your utility company.

SunSent Solar is ready to help you run the numbers for your home, factoring in current equipment costs and realistic utility rate projections. The math is simple: self-generated power is guaranteed stable and low-cost; utility power is guaranteed unstable and rising.

Take control of your energy future. Contact SunSent Solar today for a free, no-obligation assessment.