CRITICAL DEADLINE ALERT: The October 10th Final Call for the 30% Federal Solar Tax Credit in St. Louis & Illinois

October 1st is here, and at SunSent Solar, we know what homeowners in St. Louis, MO, and Western Illinois are thinking: Is it too late to go solar? Is the sun still strong enough to make it worth the investment this late in the year?

The answer is a resounding YES, and more importantly, our absolute deadline to secure your installation slot to claim the full 30% Federal Solar Tax Credit (ITC) this year has been extended to October 10th.

Don't let the changing leaves distract you from claiming this massive financial incentive. Now is the time to act, and here is the data that proves why fall is a surprisingly perfect season for your residential solar installation.

The Fall Advantage: Why Cooler Weather Means Peak Solar Efficiency

The common misconception is that the blistering heat of summer is when solar panels perform best. The truth, supported by decades of data, is that solar energy systems actually prefer cooler temperatures.

The Science: Efficiency vs. Heat

All high-quality photovoltaic (PV) panels are rated for efficiency under Standard Test Conditions (STC) at an operating temperature of 77∘F (25∘C).

- Summer Reality: On a 95∘F day in Missouri, the dark surface of a rooftop solar panel can easily reach 140∘F or higher. This heat increases electrical resistance, leading to a measurable drop in efficiency (typically 10% to 15% below the peak rating, depending on the panel’s temperature coefficient).

- Fall Advantage: The crisp, clear air of October and November keeps your panels significantly cooler, closer to that optimal 77∘F benchmark. This cooler temperature boosts efficiency, allowing your solar system to convert more of the available sunlight into usable electricity.

This "Fall Efficiency" advantage helps compensate for the shorter daylight hours, making October one of the most productive months for energy quality.

Midwest Sun Data: A Deep Dive into October & November Production

For homeowners in the St. Louis metro area, St. Charles, MO, and Western Illinois, our solar systems are engineered to maximize performance across the entire year, utilizing both the sheer volume of summer sun and the high efficiency of the fall.

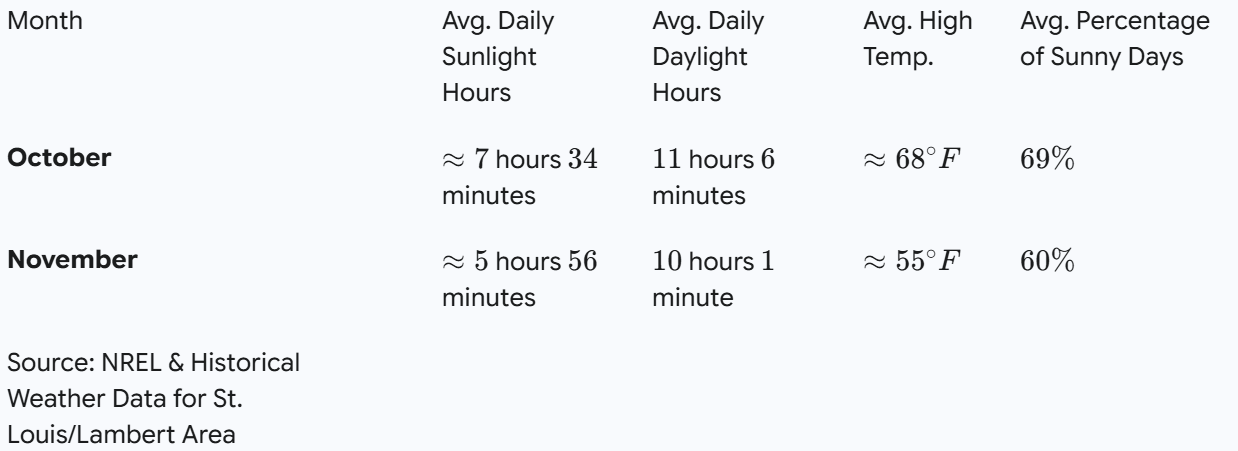

Here is the historical sun data that confirms why our systems thrive in autumn:

The data is clear: even as temperatures drop, we still see a high percentage of sunny days and a significant number of daily sun hours. This consistent, high-quality solar resource, combined with peak panel efficiency, ensures your solar panels for home continue to deliver strong performance.

The Year-Round Financial Case for Solar Power

Choosing solar power is a long-term strategy. Your residential solar installation is sized based on your entire annual energy consumption, ensuring maximum savings over 30+ years. The high production months (May-Sept) generate huge energy credits via Net Metering (in partnership with Ameren and local utilities), and the high-efficiency fall/winter months help offset the heating demands of the season.

FINAL WARNING: Lock in Your 30% Tax Credit by October 10th

This is the most crucial part of your decision. The single largest financial incentive for homeowners, the Federal Solar Investment Tax Credit (ITC), is a dollar-for-dollar reduction on your federal tax liability equal to 30% of your total system cost.

The hard reality is this: To claim the credit for the 2024 tax year, your solar installation must be "placed in service" (fully installed and connected) by December 31st. Due to the complex and time-consuming process of permitting, utility approvals, and scheduling, SunSent Solar must have your signed agreement in hand by October 10, 2025.

- A $30,000 system? That's a potential $9,000 lost if you wait.

- A $40,000 system with battery storage? That’s a potential $12,000 lost!

Don't wait for the November rush or the December freeze. Contact SunSent Solar today to guarantee your 2025 tax credit eligibility.

Frequently Asked Questions

Q: Will my solar panels produce enough in winter with shorter days?

A: Yes. While winter days are the shortest, two factors compensate:

1) High Efficiency: The cold air boosts panel efficiency.

2) The Albedo Effect: On sunny winter days, snow on the ground acts like a mirror, reflecting extra sunlight onto your panels, giving you a surprising production bump.

Q: Does this deadline apply to everyone in Missouri and Illinois?

A: Our October 10th deadline is specifically for new SunSent Solar customers in our local service areas (St. Louis, St. Charles, and Western Illinois) who want to guarantee their project completion before the December 31st tax credit cut-off. Installation timelines are impacted by permitting backlogs, which is why we must enforce this strict cut-off date.

Q: What exactly does the 30% Tax Credit cover?

A: The ITC covers 30% of the cost of the entire project, including the solar panels, inverters, mounting equipment, labor for the solar installation, and the cost of an integrated home battery storage system (like a Tesla Powerwall or Generac Power Cell) if included in the system design.

Q: How do I get started with SunSent Solar right now?

A: It’s simple and fast:

- Call us or submit a form for a free, no-obligation virtual consultation.

- We use satellite imagery and your utility data to design a custom, high-efficiency solar energy system for your home.

- Sign your agreement before October 10th to start the permitting process and lock in your 2024 tax credit eligibility.

SunSent Solar: Your Local Experts for High-Efficiency Residential Solar in St. Louis & Western Illinois.

CALL NOW TO LOCK IN YOUR 30% CREDIT: (636) 757-3083