Trump Says Green is 'Bankrupt,' But This Data Proves Solar is Saving Midwest Homeowners Thousands

Tired of seeing your utility bill spike while politicians debate energy costs? It’s time to stop paying more and start saving more with solar. A recent POLITICO analysis of government data confirms what we've known all along: states that embrace wind and solar power are overwhelmingly more likely to have lower electricity prices for consumers.

Despite claims from some high-ranking officials that renewable energy is too expensive and drives prices up, the data from the U.S. Energy Information Administration (EIA) paints a completely different picture.

The Hard Facts: Green Energy is the Money-Saving Choice

The evidence is clear and contradicts the narrative against clean energy:

- Lower Prices in Solar States: Among the states that draw higher-than-average shares of their power from wind and solar, 17 of 22 had below-average electricity prices (EIA data, June).

- Texas is Proof: Even a fossil fuel-heavy state like Texas, where wind and solar produce over 30% of the energy mix, has a lower-than-average power price of 10.24 cents per kilowatt-hour. Experts confirm that the rapid expansion of renewables in Texas has helped keep average prices down over time.

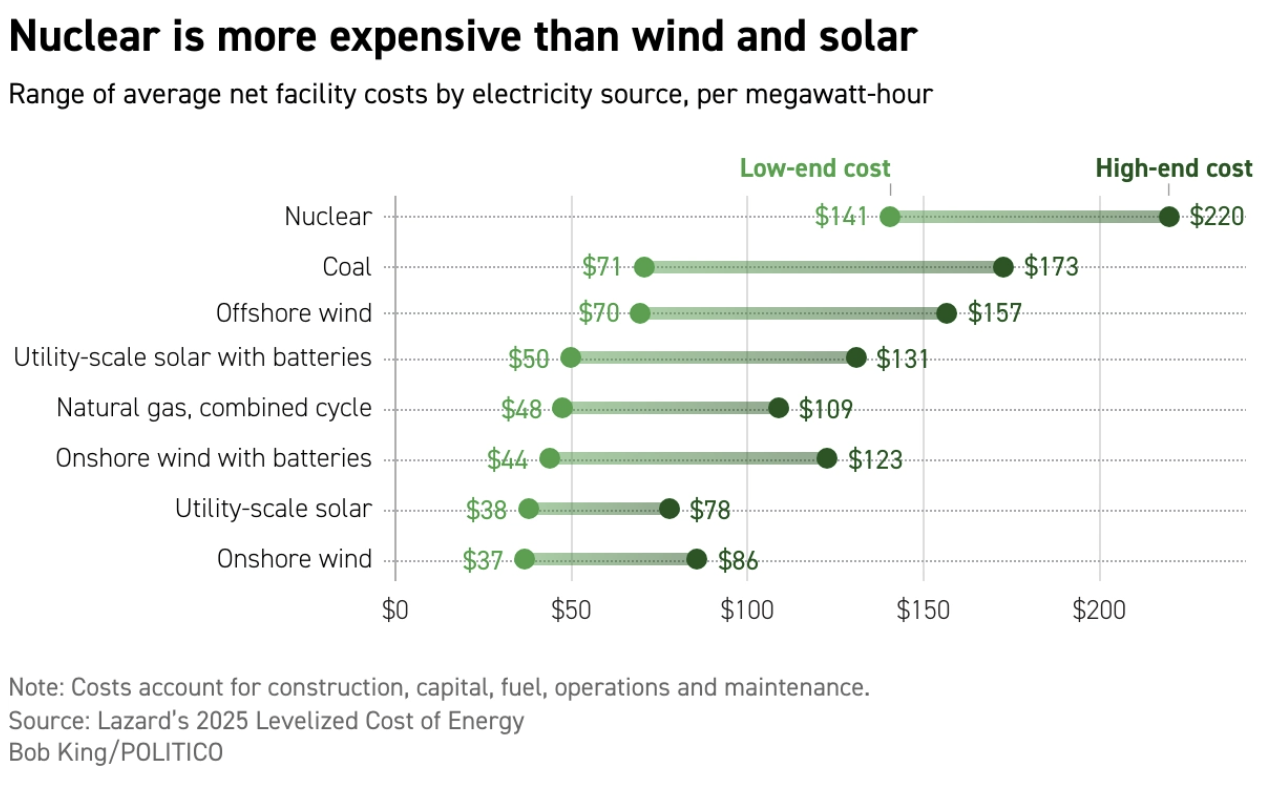

- The Cheapest New Power: When utilities need to build new power sources—which is happening now due to soaring demand from technology like data centers—solar and wind are the clear, cheapest choice over new natural gas, coal, or nuclear, even without federal subsidies. The Levelized Cost of Electricity (LCOE) for utility-scale solar is as low as $38 per megawatt-hour, dramatically cheaper than the alternatives.

- Outpacing Price Hikes: While U.S. power prices overall have risen an average of 23.4% in the last four years, many states that are aggressively adding green power to their grids saw price hikes below that national average.

This powerful data proves that adopting solar energy is not just an environmental choice—it’s a smart financial move that shields you from rising utility costs and political rhetoric.

Why Residential Solar is the Midwest's Best Energy Defense 🛡️

Here in the Midwest, you don't have to wait for your utility company to embrace large-scale renewables to start seeing savings. By installing a residential solar system, you take control of your power costs and energy future, right now:

- Slash Your Monthly Bills: Homeowners across the Midwest, including in Illinois and Missouri, are already reporting utility bills as low as $10-20 per month after going solar. Some customers even see negative bills—meaning the utility owes them money thanks to programs like Net Metering!

- Guaranteed Savings for Decades: Solar panels are warrantied to last for 25 years or more, securing your low energy rate for a generation and protecting you from future price spikes and soaring utility rates.

- Massive Incentives Expiring SOON: The single biggest incentive to go solar is the 30% Federal Solar Tax Credit (ITC). This uncapped credit allows you to claim 30% of your total system cost (including solar panels and battery storage!) against your federal tax liability. For a $30,000 system, that’s $9,000 back in your pocket!

Your Midwest Solar Partner: SunSent Solar

You need a solar partner you can trust in the Midwest—one with a proven track record of quality, honesty, and expertise. That partner is SunSent Solar ☀️.

- Midwest Experts: We understand the unique needs and local utility programs—like Ameren's Net Metering—in St. Louis, Western Illinois, and the surrounding areas.

- Customer-First Service: Our clients consistently praise our professional, non-pressuring consultations, high-quality work, and rapid responsiveness throughout the entire process.

- Protect Your Home: As experienced solar installers and roofing experts, we ensure your installation is water-tight and professionally integrated, giving you peace of mind.

Don't miss the chance to lock in the savings that come with clean energy.

CRITICAL DEADLINE ALERT: Lock in Your 30% Tax Credit!

The 30% Federal Solar Tax Credit (ITC) is a massive incentive that can shave thousands off your installation cost. However, due to complex utility approvals and installation scheduling, SunSent Solar has an absolute deadline for new customers to guarantee your project is completed in time to claim the full credit for this tax year.

- The Final Cut-Off: To guarantee your project is "placed in service" (installed and connected) by the December 31st deadline, you must sign your agreement with SunSent Solar by this Friday, October 10th!

- Don't Wait, Don't Lose Out: Missing this Friday's cut-off could mean losing the full 30% credit—a potential loss of $9,000 to $12,000 or more!

Call SunSent Solar TODAY for your free, no-obligation consultation. Time is running out to go solar with the full 30% tax credit!

Frequently Asked Questions (FAQs)

Q: Does solar power really lower electricity prices?

A: Yes! A recent POLITICO analysis of EIA data shows that states with higher adoption of wind and solar are far more likely to have below-average electricity prices. For homeowners, installing a residential system like those from SunSent Solar lets you generate your own power, drastically reducing your reliance on the grid and lowering your monthly utility bills.

Q: Why is the 30% Federal Solar Tax Credit so urgent?

A: The 30% Federal Solar Tax Credit (ITC) is set to expire or be significantly reduced very soon. To legally claim the full credit for this tax year, your system must be installed and operational by December 31st. Due to the long process of permitting and utility approval, SunSent Solar has a firm sign-up deadline of this Friday, October 10th, to ensure we can guarantee your project completion.

Q: How much can I save by going solar in the Midwest?

A: Savings can vary based on your home and energy use, but many SunSent Solar customers in the Midwest (St. Louis, Illinois, etc.) see their utility bills drop to the minimum monthly charge (often $10-$20). By generating excess power, many clients also benefit from Net Metering, which can result in negative bills where the utility credits them for their extra energy.

Q: Does the cold weather in the Midwest affect solar production?

A: Not as much as you might think! Solar panels are actually more efficient in the cold because the lower temperatures increase their electrical performance. The clear, crisp air in fall and winter can often make October and November some of the most productive months for energy quality.

Q: What does the 30% Tax Credit cover?

A: The uncapped 30% ITC covers the full cost of your solar project, including solar panels, inverters, mounting equipment, installation labor, permitting fees, and even an integrated home battery storage system (like a Tesla Powerwall or Generac Power Cell).